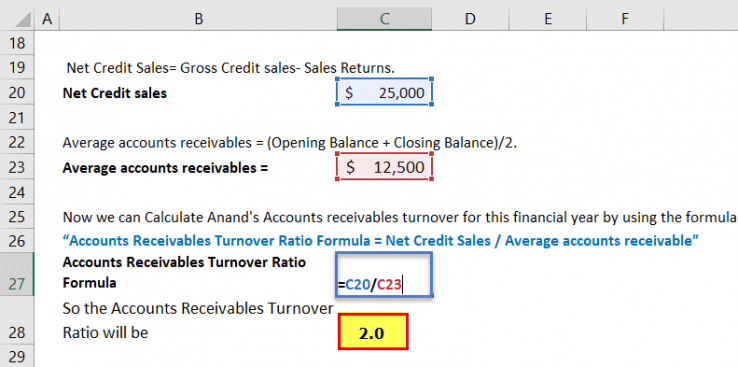

In addition, the accounts receivable turnover often is posted as collateral for loans, making a good turnover ratio essential. In turn, it means the company has a better cash position, indicating that it can pay off its bills and other obligations sooner. A higher ratio means that the company is collecting cash more frequently and/or has a good quality of debtors.In other words, when a credit sale is made, it will take the company 182 days to collect the cash from the sale. Receivable turnover = 8,00,000 / 4,00,000 = 2.įrom the above example, the turnover ratio is 2, which means that the company can collect its receivables twice in the given year or once in 182 days (365/2).On 1st January 2010, the accounts receivable was $300,000, and on 31st December 2010 was $500,000. In 2010, a company had a gross credit sale of $1000,000 and $200,000 worth of returns. Average accounts receivables – To find out the average accounts receivable (net), we need to consider two elements – accounts receivable (opening) accounts receivable (closing) and find the average of the two.And then, we need to deduct any sales return from the credit sales. We need to separate the cash sales and credit sales. Net Credit Sales = Gross Credit Sales – Returns (or Refunds). We need to keep in mind that we cannot take the total net sales here.read more is one thing, but collecting this ‘interest-free loan’ from the debtors is another. The borrower can access any amount within the credit limit and pays interest this provides flexibility to run a business. Providing a line of credit Line Of Credit A line of credit is an agreement between a customer and a bank, allowing the customer a ceiling limit of borrowing. Additionally, there is always the possibility of not recovering the payment. On the other hand, a lower turnover is detrimental to a business because it shows a longer time interval between credit sales and cash receipts. It is calculated by determining how frequently a company manages its average accounts receivable over a specified period.Ī higher accounts receivable turnover ratio is desirable since it indicates a shorter delay between credit sales and cash received. The accounts receivable turnover ratio indicates how effectively a business collects credit from its debtors. Accounts Receivable Turnover Ratio Meaning

0 kommentar(er)

0 kommentar(er)